In a short, direct article Scott Hodge debunks one of the radical left’s essential talking points, namely that the American rich don’t pay enough taxes to support their poorer countrymen. On the contrary, the U.S. system is more liberal than any other country in the Organization for Economic Co-operation and Development (OECD):

In a short, direct article Scott Hodge debunks one of the radical left’s essential talking points, namely that the American rich don’t pay enough taxes to support their poorer countrymen. On the contrary, the U.S. system is more liberal than any other country in the Organization for Economic Co-operation and Development (OECD):

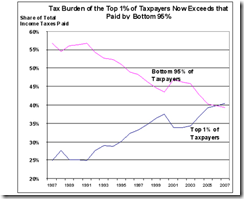

Indeed, the IRS data shows that in 2007�the most recent data available�the top 1 percent of taxpayers paid 40.4 percent of the total income taxes collected by the federal government. This is the highest percentage in modern history. By contrast, the top 1 percent paid 24.8 percent of the income tax burden in 1987, the year following the 1986 tax reform act.

Remarkably, the share of the tax burden borne by the top 1 percent now exceeds the share paid by the bottom 95 percent of taxpayers combined.

Hodge’s conclusion needs no further comment:

We are definitely overdue for some honesty in the debate over the progressivity of the nation’s tax burden before lawmakers enact any new taxes to pay for expanded health care.

An honest debate would be great. But the truth is, there’s nothing else to say.